Businesses located in bustling economic hubs are more become quickbooks certified likely to pay premium bookkeeping fees, especially if they require specialized services or complex financial management. Here is a look at how you will include the forecasted accountant cost into your price calculations when utilizing the 2 pricing methodologies that have been previously explained. Depending on how much work you have and how long you need services, a contracted worker might be a better option.

You have to use an hourly rate.

One way you can determine how much to charge is to tie each task to a dollar amount. When you’re first starting out, it’s hard to get a grasp on that, though, which is why I like to put it based on terms of approximate hours worked. Most likely, you already have an hourly rate in your mind that you’d like to be working at, and you likely did not get into bookkeeping to be making $10 an hour. But the hourly rate is becoming outdated with the dominance of technology. Tech makes once time-consuming work quick, and in many cases, effortless. This means that regardless of a service’s value to your clients, you’re capping your pricing based on how long it takes to deliver that service.

With the right technology, you what are operating expenses definition and meaning can automate bookkeeping processes and tasks that once took hours of your time. Marketing the services that add value to your clients outside of your typical responsibilities is a great way to increase revenue. By definition, fixed-fee pricing is inflexible, and in a complex industry, inflexibility can cost you money.

Overall stats of a large client

Value-based pricing, instead, rewards experience and tech fluency. It’s the future in a changing accounting industry, where you can utilize tech to increase efficiency and output. Whatever structure and pricing you go with, make sure to lay it all out on the table for current and prospective clients. That way, there are no surprise fees, and clients know what to expect from you. You may also consider throwing in other costs, like a fee for an initial consult, to your pricing structure. Many clients may be willing to pay a little more in exchange for trustworthy knowledge and training.

Try our payroll software in a free, no-obligation 30-day trial. The overall cost depends on various factors, the most important being experience, education, and certifications. Although not a crucial factor, it’s important to ensure the bookkeeper has experience working with software that you find convenient. Having the proper education and experience is crucial, but it’s not the most important factor in determining the price of the service.

questions to ask yourself before hiring a bookkeeper

- There just seems to be a visceral objection to paying for things that don’t directly improve sales.

- When it comes to pricing, clients are only willing to pay a premium for a service they perceive as truly valuable.

- For example, a manufacturing company might need inventory management, while a retail business might require point-of-sale integration.

- If you have a client with one bank account and 400 transactions, that’s going to take significantly less time than if you have a client who has 4 bank accounts each with 100 transactions.

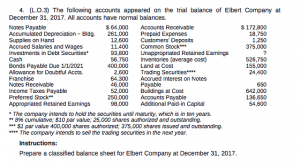

But then find yourself in a position handling a significantly higher per month amount of bank accounts and transactions down the road. Since your agreement doesn’t specify what is and what is not included in monthly bookkeeping services, it’s hard for you to increase your price without potentially souring the relationship. The burden is on you to make your service clear as basic bookkeeping services per month can have a wide range of outcomes. What is the difference between small, medium, and large client accounts for bookkeepers? Let’s break down the different sizes to their revenue, employee numbers and other key metrics. Then we will compare this to the fixed-rate monthly pricing I charge for bookkeeping services along with the bookkeeping tasks I do for each one.

I believe one of the main challenges that accountants are having moving to an upfront pricing method is poorly defining their scope of work per month. This is easier in transactional items like accounts payable, a tax return, or tax return preparation, but all additional services should have limitations. Essentially, whether in bookkeeping pricing, tax services pricing, or any other service, you need to know in advance exactly how you will deliver the work. If you aren’t in a position to define your scope clearly, then you likely don’t understand the situation well enough to be able to price it.

Here, every single price that you offer is going to be different and will take into account the uniqueness of that particular situation. It also takes into account that different people are willing to pay different prices for the exact same thing. Value pricing takes a bit of a different approach compared to fixed pricing.

Lawyers more often how variance analysis can improve financial results use this, but bookkeepers and accountants can use this method too. Even if you plan to charge a fixed rate eventually, it can be a good idea to bill by the hour for the first few months. The client may require additional services from you in order to set them up on a new system or clean up the mess left by the previous bookkeeper. I find cleanup projects always take longer than the client expects.

This method is less dependent on the unique situation of each and every one of your clients and is more dependent on the pricing that you have established beforehand. You’ll need to set a menu of all of your additional services and then attach a price to each one. Your services agreement should include a list of which financial statements will be provided, and how often they will be delivered. In a billable hour approach with per hour pricing, you let the clock run and your price is based on the time you spent. You send out an invoice afterwards and hope that you don’t have to deal with any write-downs. Here, if you go out of scope, well, you keep charging for the time that you spend.